CeMAP Module 1 Certificate in Mortgage Advice

Best Selling Mortgage Advice Qualification | Premium Quality Video Tutorials | Expert Tutor Support | Instant Access

Global Edulink

Summary

- Tutor is available to students

Add to basket or enquire

Overview

➤ Register Now! with The Most Sought-After CeMAP (Module 1) Course!

★SPECIAL DISCOUNT PRICE★

--LIMITED TIME OFFER--LIMITED TIME OFFER--LIMITED TIME OFFER--

PRICES SLASHED!!

'ENROL NOW' £199 ONLY (was £399) Hurry up!

➽Premium-Quality Video Tutorials!

CeMAP Certificate in Mortgage Advice : MODULE 1

Want to build a lucrative career in the UK’s mortgage industry?

CeMAP Certification in Mortgage Advice (Module 1) course is the most relevant qualification for learning the UK’s laws and practices to help build a career in the professional mortgage industry.

The CeMAP Certificate in Mortgage Advice course is trusted by mortgage professionals in the United Kingdom and the CeMAP course will fully equip you with adequate and fundamental knowledge of pursuing your career goals in both the public and private banking sectors.

Globally Recognised CeMAP Certificate in Mortgage Advice is a regulated qualification by the Financial Conduct Authority (FCA).

The stepping-stone to prepare learners for the official CeMap Certificate in Mortgage Advice course!

This course offers,

- Insights into the UK’s Financial Services Environment and Financial Regulations

- The robust skills and qualifications to succeed as a mortgage advisor

Why Choose Global Edulink to take the CeMap Certificate in Mortgage Advice?

The CeMAP Certificate in Mortgage Advice fully online course has been designed by industry-leading professionals to allow you the best opportunity for self-leaning.

You will receive full support from our dedicated team to get access to the relevant information required to succeed as a mortgage advisor.

➽ Premium Quality Interactive Video Tutorial course conducted using engaging visual elements

➽ Easy-to-access online learners’ portal

➽ Unlimited Access to the course for 365 days

➽ 100% flexible course with learning at your own pace

➽ Perpetual career-enhancement opportunities

➽ Excellent ratings on Trust Pilot and other online review platforms

➽ Reliable customer support

➤ REGISTER NOW!

Qualification

LIBF Level 3 Certificate in Mortgage Advice and Practice

Course media

Resources

- CeMAP Certificate in Mortgage Advice (MODULE 1) : Brochure - download

Description

✦COURSE CURRICULUM : CeMAP Module 1✦

➤UNIT 1 : Introduction to Financial Services Environment and Products (ITFS) :

- The Financial Services Industry

- Financial Products

- The Financial Planning Process

- Financial Services Legal Concepts

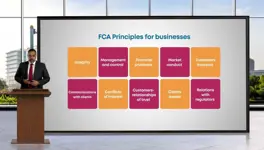

➤UNIT 2 : UK Financial Services and Regulation (UKFS)

- The Regulations of Financial Services

- FCA Rules for Firm

- FCA Conduct of Business Rules

- Consumer Credit Regulation

- Complaints and Disputes

- Anti-Money Laundering

- Data Protection

Official CeMAP Exam Details

★Taking this course will be astepping-stone to prepare learners for the official CeMAP examination

Our expert tutors will provide guidance to all learners to register with the London Institute of Banking & Finance (LIBF) to take the official CeMAP Exam.

Exam Format:

- Two Units, 50 multiple choice questions each

- Learners need to obtain 35 marks out of 50 to pass the exam

About the Tutor

Simon Dhillon is an independent compliance consultant in the United Kingdom with extensive experience in financial services. He specialises in multiple business areas including mortgage, DPA, sales, fraud, team management, retail banking, and commercial banking. He is presently the Advisory Consultant at Huntswood (financial services) and has previously held job roles such as Mortgage Advice Specialist, Investigations Team Manager, and Outcome Testing Analyst. He is a fully qualified Mortgage Advisor and Member of the London Institute of Banking and Finance. Simon works diligently to find individual solutions, delivers projects accurately, and demonstrates attention to detail and high-quality work. Simon is enthusiastic about imparting his skills and knowledge of the finance industry to learners.

Learning outcomes

- Understanding the purpose and structure of the UK financial services industry

- Learn all about the UK’s financial services environment and products by taking this CeMAP Mortgage Advice course

- Understand the UK’s financial services and regulations by taking this CeMAP Mortgage Advice course

- Learn about Data Protection Act 1998 and the FCA regulations through this CeMAP Mortgage Advice course

- The CeMAP course will discuss about different types of clients and key legal concepts that apply to their cases

- Discover the essential terms and rules of UK taxation and social security systems

- Get enjoyable and lucrative career opportunities in the UK

Register Now!

Who is this course for?

- Mortgage Advisor/ Broker

- Private Banking Assistant

- Relationship Support Assistant

- Protection Advisor

Requirements

There are no formal qualifications required to take this CeMAP Certificate in Mortgage Advice course

Career path

The CeMAP Certificate in Mortgage Advice will help you to reduce the knowledge and skills gap in the professional mortgage market of the UK and raise your demand in the industry. :

- Mortgage Advisor/ Broker – £30 000

- Private Banking Assistant – £33 000

- Relationship Support Assistant – £33 000

- Protection Adviser – £50 000

- Business Owner – Mortgage Adviser – £30 000 - £55 000+

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.